FAQ on Recent Compliance Changes

Purpose:

The purpose of the document is making clients aware of the recent operational changes that are guided by SEBI and vis-à-vis exchanges. The document created hereby is as per clarification received yet. Some points may change based on further clarification received.

Changes in Short:

There are 2 Major Changes:

- Requirement of Upfront Margins in Equity Market and Penalty for non-submission, maintenance of required margins, as per SEBI Circular dated November 19, 2019

- Submission of collaterals as Margin via Margin Pledge for all segments, as per SEBI Circular dated February 25, 2020

Understanding Changes:

- From 01st August 2020, Stock lying in Client DP where POA is with MSFL, will not be considered as a valid margin for Margin Reporting. In order to facilitate margin reporting in all segments we at MSFL have to fetch all stocks in Collateral Account. Stock lying in Client DP where POA is with MSFL, will not be allowed for limit from the last week of August, 2020.

- From 28th August 2020, Stocks lying in CUSA and POOL will also not be available as Margin for Margin Reporting in any segments. Stock lying in POOL can be considered as margin for the sell transaction.

- From 28th August 2020, All stock in Collateral will be returned to clients and will not be considered as margins for margin reporting. Clients will have to give such shares via pledge request only.

- From Transaction on and onwards 28th August 2020, short margins in the Cash Market will attract penalties similar to Derivatives Segment.

-

Margins in Cash Markets are charged on all transactions whether Bought or sold, exception, sold where bought today (Intraday). Hence following transactions will attract margin reporting, and if not satisfied, may attract penalty.

- Stock bought during the day where not sold today.

- Stock sold during the day where not bought today.

- Stock sold which was bought on the previous day (BTST).

- Stock sold against debits.

- Stocks sold which were pledged to MSFL.

- Stock sold for any other genuine purpose.

- Stock bought against full credit.

- Intraday and delivery limit will be available on clear balance only.

Chapter 1: Requirement of Upfront Margins in Equity Market and Penalty for non-submission, maintenance of required margins:

-

What is the upfront margin requirement?

Till this day, upfront was required for derivatives segments only. That is to say, clients trading in NSE F&O/CDS/MCX/NCDEX/ICEX will be aware of charging margins. A similar margin is now charged in Cash Market transactions. -

Stock lying in CUSA can be sold without margin?

Yes, CUSA can be sold without margin, and credit will be available on that day for buying other stock or for other margin requirements. -

Stock lying in DP POA which is not pledged can be sold without margin?

Yes, such stock can be sold without margin, and credit will be available on that day for buying other stock or for other margin requirements. -

Can the stock bought on the previous day can be sold without margin (BTST)?

No, such stock cannot be sold without margin. The stock which is expected today, that is stock bought on the day before the previous day, can be sold without margin. If, due to market short, the delivery is not received, margin will be charged on such sold stock. For example Reliance 100 Qty Rs 2000 bought on Monday will require 20% ie 40000/- margin. On Tuesday if the client wants to sell the 100 Reliance Rs 2100 which bought on Monday (previous day) needs again 20% ie. 42000/- margin -

Stock pledged in margin can be sold without margin?

No, stock pledged in margin and if the margin is utilized, it cannot be sold in the market without margin. -

Why is it that some stocks are sold and some are stocks that cannot be sold without margin?

Stocks that are readily available for pay in which are not pledged as margin can be given to CC as Early Pay in (EPI). Hence, such stock can be sold without margin. As per new regulations of Peak Margin requirement to be implemented from December 01st 2020, such facility will be discontinued. -

What margins will be charged?

In the Cash Market, a minimum of 20% or VaR (Value at risk) and ELM (Extreme Loss Margin) are charged by exchanges. These margins are charged in Percentage terms, hence if a script has a VaR margin of 15% and ELM of 5% and client wants to trade for a value of 5lacs, whether buy or sell, client needs to pay 1lac as upfront margin (5,00,000 X (15+5)/100). In addition to this, M2M Margins are charged and sometimes additional margins are charged that are required to be paid by T+2 day. -

Why are such margins charged?

These margins are charged by exchanges, more technically, by clearing corporations. This is done to safeguard the interest of investors. -

Is Limits available:

- For Delivery Purchase? : Yes, Limits will be available, but the client has to pay an upfront Margin equivalent to a minimum of 20% of trade value VaR and ELM of the value of stock to be purchased, or Span + Exposure margin in case of Derivatives, whichever is higher.

- For Bill to Bill Transactions? : Bill to Bill transactions are for accounting purposes. Client needs to maintain an upfront margin equivalent to 20% of trade value VaR and ELM of value of stock to be purchased. In case of sale, if the stock is in DP POA where stock is not pledged as Margin, the stock can be directly sold.

- For Intraday Trading? : Yes, limits will be available, but the client has to maintain upfront margin equivalent to 20% of trade value or VaR+ELM of the trade value or Span + Exposure in case of Derivatives.

- For Hedge / Spread positions? : Clients (BM or RM in representation of their clients) have to ask for additional limits, RMS Department may approve, and reduce the limit to normal once the trade is done.

- For Delivery to be sold in Other DP / Non-POA? : Yes, Delivery can be sold. The client needs to maintain upfront margin for such sale transactions. Such margins are released once the payin of the stocks is done.

- Stock to be sold that is acquired from IPO? : If such stocks are lying in a DP account where POA is given, the client may directly sell the shares. In case of other DP, client needs to pay upfront margin for such sale transactions. Such margins are released once the payin of the stocks is done.

-

Will there be any changes in limit setting?

Yes, there will be a change in the limit set in ODIN for the Cash Market.All transactions will be done in the “Delivery” product, both Buy and sell.Limits will be available for stocks in different beneficiary is given as below:

Particular DP POA Yesterday Stock

(T-1)POOL Stock

(T-2)CUSA Stock Margin Pledge

and MTF boughtFree Stock Limit allowed before selling YES NO NO NO NO Selling allowed without margin NO YES NO YES YES Limit allowed after selling NO YES NO YES YES Can buy back sold stock without margin YES NO NO NO NO

-

Is Margin charged even if clients have credit in my ledger?

Yes, Margin is charged even if the client has credit in the ledger, but the ledger credit can be reported as upfront margin received and hence the client need not pay any margins. -

Whether stock lying in DP POA can be considered as margin?

No, all stocks lying in DP POA will not be considered as margin. Only a value of stock lying in DP POA having Margin Pledged, whether or not repledged, can be considered as margin. -

Whether stock lying in CUSA can be considered as margin?

No, for this purpose we will give all stock in DP POA, and generate advance pledge options. Stocks where advance pledge is not received, may be sold off on T+3 day. Revised RMS policy will follow in due course. -

Elaborate BTST?

BTST can be better understood from the tables below:

CASE 1: Normal case Day Due Ledger Stock Type Value Margin charged Required Margin Comment Friday (EOD) 40,000 0 Monday 40,000 0 Buy 1,00,000 30,000 30,000 No Shortfall, no penalty Tuesday 40,000 0 Sell 1,00,000 30,000 60,000 Margin shortfall of 20,000 hence penalty Wednesday # -60,000 1,00,000 30,000 30,000 Margin requirement to be met.

CASE 2: Client having full credit Day Due Ledger Stock Type Value Margin charged Required Margin Comment Friday (EOD) 1,00,000 0 Monday 1,00,000 0 Buy 1,00,000 30,000 30,000 No Shortfall, no penalty Tuesday 1,00,000 0 Sell 1,00,000 30,000 60,000 No shortfall, no penalty Wednesday # 0 1,00,000 30,000 30,000 No shortfall as the margin reporting will be done.

# Please note: On Wednesday EOD, most of the times stocks are received from exchange, and pay in is done for Tuesday sold, and hence no margin will be charged. But in some cases like Market short for stocks bought on Monday or due to Multiple settlement or for any other technical reason, if MSFL is not able to process EPI for stock sold on Tuesday, such stocks can be used to knock off against the margin requirement against selling of the stock. -

How will the client limit be set?

Client limit will be set as a combination of MSFL risk management policy, and exchange margin reporting. We at MSFL will make a best effort to avoid margin shortfall, where the client has not demanded the additional limits. But if margin is charged by exchange, the client needs to meet the margin requirement, or bear the penalty. Having said this, the following table will show the calculation for the limit set. -

What is the amount considered as margin?

Clear ledger across all segments + Value of stocks lying in DP POA where Margin Pledge is given. Value of stock is considered at the rate of T-1 closing price, as reduced by VaR and ELM charged on T Day. Hence for any valuation of stock for margin requirement on any Wednesday, the stock lies in clients’ DP POA where margin pledge is done on or before this Wednesday and at closing price of Tuesday and reduced by VaR and ELM of Wednesday EOD. -

Can clients pay additional margin? By what time.

Clients can pay additional margin by cheque on the same day, preferably before trade. Such cheque needs to be deposited on or before T+1 trading day before 11:00 AM, that is first clearing. -

What is the penalty charged on short margin in Equity and CDS Segments?

The available margin in clients’ account, being ledger and stock in Clients’ DP POA having Margin Pledged, is being summed up to form Margin available. Such margins are then allocated amongst the margin requirement of various segments. If, for a given client, margin is required in all Six segments of CM, FNO, CDS, MCX, NCDEX and ICEX then:- All available margin is allocated to Cash Market requirements.

- If any excess margin is available, such excess margin will be allocated to Equity Derivatives segment.

- If then any excess margin is available, such excess margin will be allocated to the Currency derivatives segment.

- And if then any excess margin is available, such margins are allocated to the Commodity derivatives segment namely MCX, NCDEX and ICEX respectively.

Short collection for each client Penalty percentage (< Rs 1 lakh) And (< 10% of applicable margin) 0.50% (= Rs 1 lakh) Or (= 10% of applicable margin) 1.00%

If Short/non collection of margins for a client continues for more than 3 consecutive days, then penalty of 5% on shortfall amount shall be levied for each day of continued shortfall beyond the third day of shortfall.

If Short/non collection of margins for a client takes place for more than 5 days in a month then penalty of 5% of the shortfall amount shall be levied for each day, during the month, beyond the 5th day of shortfall.

Notwithstanding the above, if short collection of margins from clients is caused due to movement of 3% or more in the Nifty 50 (close to close) on a given day, (day T), then, the penalty for short collection shall be imposed only if the shortfall continues to T+2 day.

Chapter 2: Submission of Margin via Margin Pledge for all segments:

-

What is the Current System of Margin Collection?

Currently, Margins are compulsorily collected for Derivatives segments, that includes NSE Derivatives, Currency derivatives and Commodity derivatives, we know them as NSE F&O, NSE CDS, MCX NCDEX and ICEX. These margins were collected as funds in ledger by cheque, or selling stock, or Stocks lying with us. -

What changes will be done in the new system?

There is a change in Margin collected as stock lying with us. Here stock lying with MSFL will no longer be considered as Margin received. Hence stock lying in CUSA, Pool A/c, Collateral A/c and even POA A/c will not be considered as Margin. -

What is the client required to do?

Client is required to give margin via Margin Pledge from his DP A/c whether or not POA. This is to say, a client is required to pledge the stocks lying in his account, where the stock will continue to be lying in his account. So, there will not be a transfer of shares. The detailed procedure for requesting margin pledge is given in Annexure 1 attached. -

What is the benefit to clients?

Client will remain the beneficial owner of the shares lying in his account, even when they are pledged for margin. Hence all the corporate actions will directly come to the clients account. Previously, in case of dividends on shares lying in Collateral accounts were received in Broking ledger, from now, such dividends will be received directly in clients’ bank accounts mapped in DP. -

What is the disadvantage of such a system?

Client will need to make an additional process on his mobile email, in order to pledge the shares as margin. -

What does the term “PLEDGE” mean?

The term “PLEDGE” simply means a legal promise made by the pledgor to give the shares to pledgee under certain circumstances like failure to pay the dues by pledgor. It is similar to a Car Loan where the asset is a Car and loan is given by bank and hence though the car remains with the client and can enjoy the benefits, he cannot sell the asset to someone else unless an NOC from the bank and procedures from RTO, etc. Here, there would not be any other authority to remove the pledge. -

Can a client sell the shares pledged as margin?

Yes, Client will have to have a spare margin for selling such shares. The value of pledged stocks, may be counted as margin subject to availability of surplus. This is to sayParticulars Ledger Pledge stock Value Value after haircut Surplus value Sell Value Margin on sale Comment Client 1 -70000 100000 75000 5000 100000 25000 Client needs to pay additional 20K margin Client 2 -20000 100000 75000 55000 100000 25000 No need to pay extra margin

Here client 1 will need to pay extra margin to sell the stock already pledged. Or an option, he can sell the stock in 5 parts in 5 days, being 20000 on each day. -

What happens if the client has not given POA and pledged the stock with MSFL?

In such a case, the client will get limits against the pledged stock after haircut, as usual. If he sells the stock, the margin for such selling will be charged. The client will have to make good the margin requirements and then request for pledge release. Once such stock is released by MSFL, the client needs to give the stock for pay in by the on-market slip as routine. -

What if the stock is lying in CUSA, POOL or Collateral Account?

Collateral accounts will be emptied by the end of August 2020; hence stock will no longer be placed in a collateral account. For CUSA and POOL accounts, clients may directly sell the stock as they are doing today. Also, the stock lying in DP POA where the client has not marked as Margin Pledge can be directly sold. The margin will even be charged on that, but early pay-in can be done from such accounts and hence, as of now clients will be able to sell the stocks directly from these accounts. -

Then why will a client give Margin pledge?

Margin pledge is to be given to make margins available for trading in all the segments. No trade will be available without margin. The limits will be available on the clear balances only. -

What is the process?

For clients, where there is a POA given. Pledge initiation will be done from the back office. Once pledge is initiated, the client will receive an SMS from NSDL/CDSL as the case may be; which contains a link from depositories. On clicking the link, a page of Depositories will be opened and the client will have to enter his PAN no and then an OTP is received which needs to be entered again.

For clients, where there is no POA, clients need to fill the Pledge request form and submit at DP front office.

It is advisable to have POA done, to avoid inconveniences.

When Margin Pledge Request is generated, client will receive a message from Depositories:-

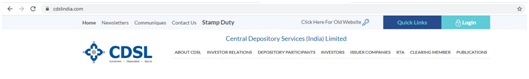

For CDSL:

- link will be available in CDSL Website:

-

Go to Quick links: and find for OTP Authentication for Pledge

-

Enter your PAN no or CDSL Account number:

- Select the Stocks to be pledged:

- Request for OTP:

- Enter OTP:

- Receive Confirmation:

- link will be available in CDSL Website:

-

For NSDL

- Clients will receive a bitly link for each transaction.

-

For CDSL:

-

What if the client misplaces the SMS, or erroneously delete the SMS, or did not receive it at all?

Clients may visit the Depository website and use the option in the Quick Link. Follow the directions as shown in Point 11 above. -

Can MSFL take clients shares from his account, where POA is given?

No, MSFL will not be able to fetch the stock for margin from POA. In case, the client has sold some stock which is not pledged, MSFL will continue to fetch such stocks from POA for Pay in. MSFL will have a right to invoke the pledge in case the client is not able/willing to pay his dues. In case of Invocation of Pledge, additional charges of stamp duty will be charged to the client. -

Can the shares given by the client as pledge can be re-pledged?

Yes, MSFL will be able to repledge the shares. But such limits against re-pledged stocks can be used by the pledgor clients only. Hence clients’ assets are definitely safe. Moreover, the client will have a complete track of stocks pledged and re-pledged in his DP A/c transaction statement. -

Can Clients ask for release of Pledge?

Yes, the client may ask to release the pledge subject to his margin requirement and ledger debits, if any.

Annexure 1

Process flow for “Margin pledge”

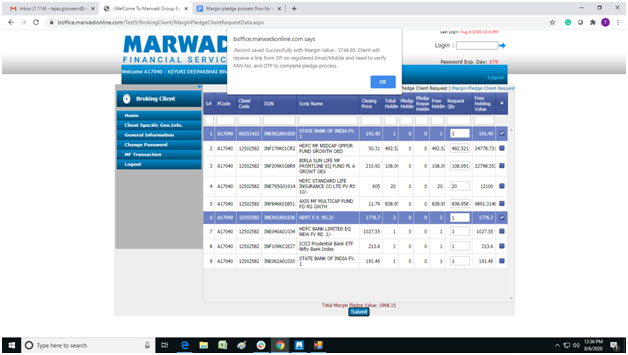

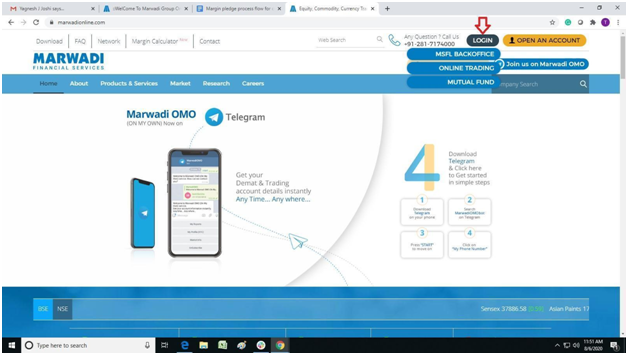

Visit www.marwadionline.com

Click on “Login”

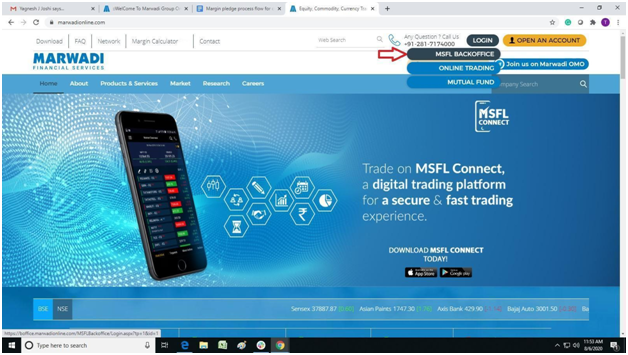

Click on “MSFL BACKOFFICE”

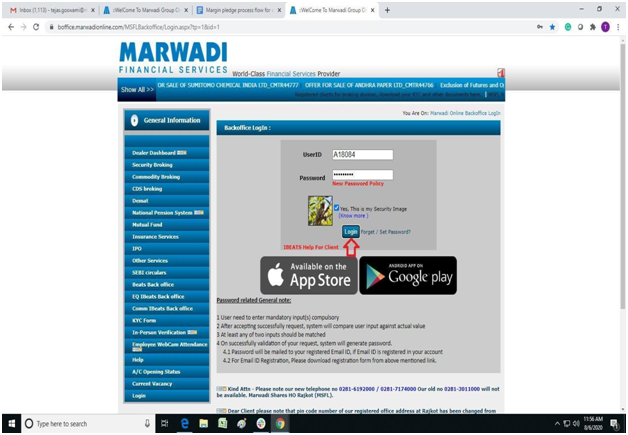

Enter the Login Credentials & Select the security image and then click on “Login”

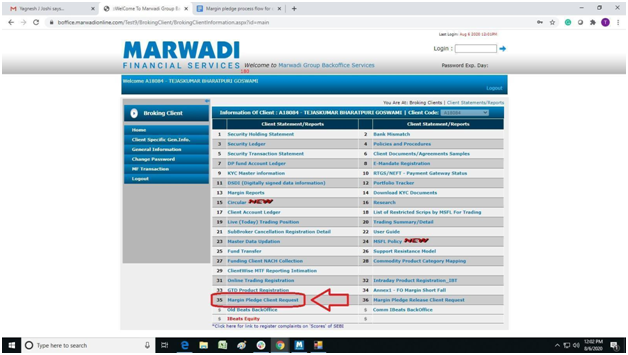

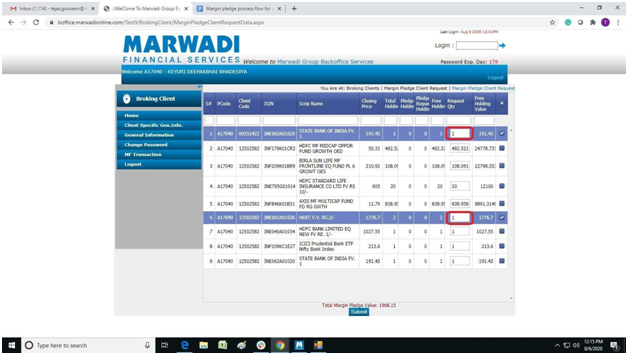

Click on “Margin pledge client request (Menu No.35)”

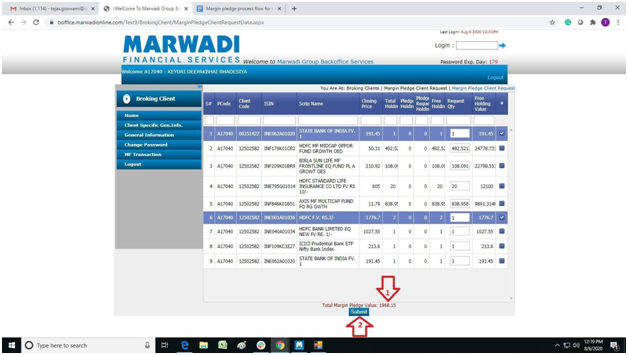

Select the securities and also put the “Request quantity”

Check the “Total margin pledge value” and Click on “Submit”

You will receive the authorization link from DP (NSDL/CDSL).